Investors did not have an easy time of it in 2015. From oil’s price slump despite rising and omnipresent tensions in the Middle East and Russia’s invasion of Ukraine to a possible exit by Greece from the eurozone and technical recessions in Canada and Japan, stock and bond markets rode wave after wave of volatility and many investors ended up in the red. How bad was it? Cash outperformed most asset classes for the first time since the 1990s.

Unfortunately, 2016 didn’t start off any better. In the first few trading days of January, contagion from China’s latest stock-market tumbles wiped out US$4 trillion in equity value worldwide. The S&P/TSX Composite Index, meanwhile, fell into a bear market, having dropped 20% since its September 2014 high. Further out on the horizon loom as many as four rate hikes by the U.S. Federal Reserve, continuing its trend toward tighter monetary policy as the American economy recovers, even if few other economies are showing anything more than weak signs of life.

“Persistent weak global growth is intensifying,” says Bruce Cooper, TD Asset Management’s chief investment officer, chalking that up to aging demographics in both the developed world and China as well as high levels of debt, whether that’s government, corporate or consumer, in many parts of the world. Both factors lead to weaker aggregate demand, which leads to slower economic growth and, ultimately, poorer investment returns — something investors are going to have to get used to unless something happens to turn things around.

Much of a portfolio’s performance in the long term is driven more by macro-economic factors and less by stock-specific factors.

In the meantime, headlines scream that one event or another will weigh down on portfolios. But that’s a little simplistic. “The market doesn’t tell you why it did something,” says David Kaufman, president of Westcourt Capital Corp., a Toronto-based portfolio manager specializing in traditional and alternative investment. “One macro affects another, and the world keeps spinning so it makes it difficult to figure out things that are affected by multiple factors.” Nevertheless, he says, more clients are asking him how events in the U.S., China and other places affect their investments here at home.

“Much of a portfolio’s performance in the long term is driven more by macro-economic factors and less by stock-specific factors,” says Pramod Udiaver, co-founder and CEO of Invisor Investment Management Inc. in Oakville, Ont. “And why? Because the global economy is so well integrated these days, which a lot of people don’t really appreciate when they think about investments.”

That lack of appreciation may be because the effects are not often direct ones, and sometimes it’s just the perception that they should change things. But that doesn’t make them any less real, and there a number of big macro-economic factors that have and will continue to play a role. “Investment securities are valued based on expected future performance, not on how a company is doing at a given point in time,” Udiaver adds. “And the future performance is largely dependent on these larger macro factors.” Most of which, for now, seem to be headwinds as opposed to tailwinds.

The red menace

China, for example, once fuelled the global economy and stock markets, especially in Canada. The Chinese economy for years has been investment-driven, which requires a lot of natural resources to build. Resources such as oil, wood, potash and many metals like nickel and copper that Canadian companies supply in abundance were needed. But two things in China are occurring that make it more of a drag on global growth and, hence, investor portfolios here at home. The country’s GDP growth is slowing from the 8-10% range to 7% or less — and, keep in mind, those are government numbers, which may overstate actual growth — and it is trying to transition its economy to one driven by consumption as opposed to investment. “Clearly, they can’t sustain the 10% growth number and markets need to understand that and then adjust our valuations,” Udiaver says.

China is the world’s second-largest economy, responsible for about 20% of global GDP, and it’s Canada’s second-largest trading partner, so any slowdown is going to cause problems. “China is not causing this low-growth world, but with China slowing now, it’s exacerbating the low-growth world,” TD’s Cooper says. “It affects Canadians, of course, because China is a big consumer of commodities.” And, as everyone knows, commodities are still about 30% of the Toronto Stock Exchange, although that’s down quite a bit from just a few short years ago. As China’s growth declines, they have less need for oil and other resources that Canada produces, which means the prices of those commodities drops. As a result, there’s less demand for the Canadian dollar, which also depreciates. Live by the petro-currency, die by the petro-currency.

Another complication is that even China’s lower-growth profile assumes that its economic transition goes well, which isn’t a given even in a government-led economy. State-owned enterprises are a big part of the economy and act in many cases like employment agencies, Cooper says. For example, it has many steel companies that should close down since they are high-cost producers in a lower-demand environment. Closing them makes sense if China really is trying to be driven by consumer desires, but it can’t since it would throw thousands out of work and, therefore, hurt demand for goods and services.

Kaufman offers one caveat: if you think China will grow, and it still is, investing in Europe and Canada isn’t as crazy as it seems now given that these are two of the least-liked markets. “Even if they were to keep growth in-house and have a massive trading deficit, they still need water, they still need potash, they still need oil, all the things that a thriving urban economy requires that they don’t have in their massive geography,” he says.

Slicker shock

It would be welcome news to the oil industry if China does keep growing, even if more modestly. The original reason behind oil’s price slump was excess supply caused by the explosion in shale oil from the U.S. and the addition of about one million barrels a day from Iraq last year. “Demand was pretty good, but not good enough to overcome supply growth,” Cooper says.

Energy companies, especially in Canada and the U.S., responded by slashing their capital expenditure budgets and workforces, which will curtail production growth in the coming years. That would normally stabilize prices and even reverse the downward trend, especially since tensions are still simmering in the Middle East. But Cooper wonders whether the slump in oil prices that renewed in late December and continued through the first week of January was more to do with slowing demand and less about excess supply. If true, that would prolong the energy industry’s agony and that of its investors.

Growth is still kind of crappy. One risk is that the market loses confidence in central banks’ abilities to engineer a recovery.

The Canadian market, as mentioned, has a high and direct correlation with energy prices and there is a domino effect on all the related businesses that service that sector, which includes the banks, perhaps the last big bastion of strength on the TSX. “The banks will experience a knock-on effect even though the direct affect is small,” says Beth Hamilton-Keen, chair of the board of governors at CFA Institute and director of investment counselling at Mawer Investment Management Ltd. in Toronto. “For example, TD has 1% exposure to oil and gas lending — but the resulting job losses and defaults by individuals will increase that secondary and tertiary effects,” She adds that also means the loonie will stay weak, as will the currencies of other countries that are heavily tied to oil.

As a result, Canadian investor portfolios will continue to be hit. The S&P/TSX 60 index, for example, consists of quite a few blue-chip companies and doesn’t have a lot of exposure to oil or other commodities. If the drop in oil impacted only energy companies and their investors, the 60 should fare better. And it has, to a certain extent. The Composite index has actually dropped over the past five years, while the 60 is slightly up. But that’s during what has arguably been the greatest bull market ever. “If you believe this massive bull market was an indicator of economic strength in a post-crisis world, then you’d have to believe Canada would have done well during that period of time,” Kaufman says. But, as has become all too clear, it didn’t.

Rise of the Fed guardians

One economy that has strengthened during the post-financial-crisis world has been the U.S., somewhat aided, of course, by three rounds of quantitative easing and interest rates that were slashed to near zero by the U.S. Federal Reserve. But the Fed, after dithering for several quarters, finally raised interest rates by a quarter point in December to 0.5%, signalling its faith that the U.S. economy was on an even keel. Some key data points such as employment, housing and consumer spending all indicate a reasonably healthy U.S. “Any interest rate increase is a positive thing,” Invisor CEO Udiaver says. “It’s a good thing for the economy, because rates are only increased when there is a longer-term expectation that the economy is going to do well.”

It’s no surprise then that the S&P 500 has been one of the stronger indexes over the past five years, but even that index struggled through 2015 and early 2016. That could be because investors believe growth rates will continue to be lower for longer, which should naturally translate into low interest rates for the foreseeable future. The Fed indicated that it expects to raise rates four times during 2016, while the market seems to be pricing in two. TD’s Cooper, however, is more pessimistic. He believes the Fed will either not raise rates at all or be content with one hike. “We think growth is going to be disappointing, and if growth is disappointing, rates are not going to go up,” he says. “And you see that at both the short end, central bank administered rates, as well as out the yield curve.” Cooper points out that 10-year Treasury yields actually declined after the Fed raised rates in December. Why? Because the U.S. economy is operating at or near full capacity so there’s little extra growth to be had.

Again, that isn’t good for equities. The link between growth and equity is really through earnings. Earnings growth in the U.S. has mostly been very good for the past six years, excluding 2015, but Cooper expects it will be pretty tepid from here on. “Part of the reason is that with low growth, companies are having trouble growing revenue and they’ve already cut costs a lot and margins are close to all-time highs,” he says. “If your revenues aren’t growing and you’ve already done all the cost cutting you can, you wouldn’t expect earnings to grow much.”

If rates do keep rising in the U.S. — a rate cut is more likely in Canada — Hamilton-Keen says certain sectors such as insurance should do better than others, depending on the number and size of those hikes. But, she adds, investors should have a balanced portfolio that has bets on both sides of the rate equation as well as bonds for ballast.

The last hike by the Fed didn’t cause much of a stir, but that’s because it was well-signalled and factored in. “The more important thing for investors in Canada will be the trend, the consistency and magnitude of rates in the future,” Hamilton-Keen says. Further hikes in the U.S. rate could lead to a strengthening greenback and an indication that the U.S. is a safe haven — a position occupied by Canada during the fiscal crisis — so investors will flood into the country.

But hiking rates also hurts the earnings of U.S. companies that derive a big portion of their revenues from foreign countries, especially if their costs are in dollars while their revenues are in weaker currencies. The cost of capital also rises. Similarly, however, Canadian companies that get the bulk of their revenue from the U.S. while their costs are borne at home should do better. Manufacturing, for example, should benefit, though it hasn’t to this point because other countries’ currencies are also depreciating against the U.S. dollar.

But at the portfolio level, Hamilton-Keen notes that any holdings investors have in U.S. or international equities probably have a different return profile than a home-biased portfolio since currency gains could account for up to two-thirds of returns. “Those gains do not necessarily represent the underlying profitability of the company, but the spread differential, which can be a headwind if you have a portfolio heavily weighted in Canadian equities,” she says.

All of which is why investors pay so much attention to any hints of what the Fed and other central banks might do. The impact of their actions on investor portfolios, as Hamilton-Keen suggests, may “well be blown out of proportion,” but the perception of macro-economic events can have just as strong effect on markets as reality can. At some point, investors may realize that all the zero interest rate policies and trillions spent on quantitative easing haven’t done a whole lot to spur growth in any case. “Growth is still kind of crappy,” Cooper points out. “One risk is that the market loses confidence in central banks’ abilities to engineer a recovery.”

Canada’s conundrum

Unlike the U.S., Canada’s central bank has not taken more rate cuts off the table. The economy flirted with recession in 2015 and remains weak, while the dollar has dropped 15% over the past year or so, which isn’t surprising when you consider the overhang from commodities and natural resources. “A slight increase in U.S. interest rates might weaken the Canadian dollar a little bit, but how much more is a big question,” Udiaver says. “We think it will float around the current levels for a bit. We will probably not see a major change in interest rates. We might actually see a further reduction or negative rates as the Bank of Canada governor has indicated.”

Of course, the BoC’s official rate is only 0.5% after it cut rates twice last year, so it doesn’t have much room left. It also indicated in January that it was content for the Canadian dollar to remain weak. That may be good for some, but it doesn’t exactly establish confidence that the economy has a chance of rebounding this year, and some areas and sectors are already suffering.

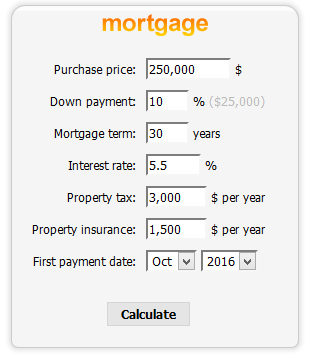

Housing, for example, is weakening in Alberta, but it’s strong in Toronto and Vancouver, where demand remains strong and there are space constraints. Any attempt to cool off the latter two markets would almost certainly mean disaster for struggling markets like Alberta’s, although the federal government has made some steps in the past few years to rein the market. But it’s Mortgage Rates that remain key and, despite the Bank of Canada’s position on rates, RBC raised some of its rates in January. For example, the five-year fixed rate rose to 3.04% from 2.94%. Is that enough to tip the scales? Probably not, even if all the other financial institutions follow suit. But a rate change of some significance over time could be the trigger for some0 Housing market pain.

“A collapse in housing comes from desperation so what’s that desperation going to look like? It’s going to comes from either rates going up and therefore people can’t afford their Mortgages, and when do you get to the point where they walk away,” Hamilton-Keen says. “Other factors could be the ceasing of lending, weak economic position.” There is, however, a saving grace: foreign investors continue to plow money into this country’s real estate.

Another positive for investors is that many believe valuations are somewhere in the range of fair, so investors should be able to ride out the expected bouts of volatility if they can tune out some of the noise, pick high-quality companies with strong balance sheets and cash flows, along with some exposure to the U.S. dollar through either equities or bonds, and some fixed income.

“We tell our clients that these are walls of worry and walls of worry are often good for markets, because there is a lot of caution being exercised by investors,” Udiaver says. “But from the past, we know that markets often climb these walls of worry. What’s not good for the market is a state of euphoria and we don’t think we are anywhere near close to that.”

Resource By:-http://landmarkfinance.com/2016/02/world-of-pain-why-investors-need-to-know-how-macro-economic-events-affect-the-canadian-market/